No one loves filing taxes, right? But this year, you can file your taxes for free using MyFreeTaxes.com.

File taxes for free with MyFreeTaxes®! Yes, for $0 you can file your federal and state returns without spending any money on tax preparation fees. So far, MyFreeTaxes has helped 1.3 million people save $260 million in tax filing fees. And this year, MyFreeTaxes is available in English and Spanish.

The secure software walks you through the filing process and screens for common tax deductions and credits you may be eligible for, like the Earned Income Tax Credit or the Child Tax Credit. If you need help, Use the Helpline to talk to a real person trained by the IRS. MyFreeTaxes’ Helpline is open daily from 10 a.m. to 6 p.m. EST to clarify filing status. Just call 1-866-698-9435.

Other tax situations covered include:

- W-2 income

- Schedule C Self Employment

- Limited interest and dividend income reported on a 1099-INT or 1099-DIV

- Student education expenses, credits or student loan interest

- Unemployment income

- Claiming the standard deduction

- Earned Income Tax Credit

- Child tax credits

- Child and dependent care expenses.

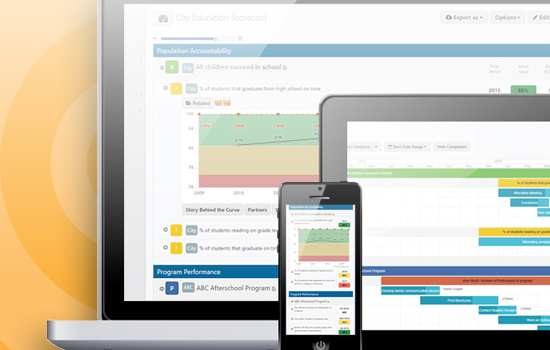

People say doing your taxes is a chore. Prove them wrong. filing taxes for free with MyFreeTaxes is fast and easy! You can do it from anywhere: your phone, tablet or laptop. You can start on one device and finish on another.

Looking for VITA sites for in-person tax assistance? Don’t worry; we got you covered! Through our partnership with LISC Toledo, individuals needing in-person tax assistance can receive it from Lutheran Social Services, NeighborWorks Toledo, Promedica Ebeid Center and Pathway. To schedule, dial 2-1-1 or 800-650-HELP to schedule an appointment.