Planned Giving

Establishing Your Legacy

By uniting the caring power of people through giving, advocating, and volunteering, United Way with our partners, tackles the complex problems our community faces. That process is dynamic, flexible, and inclusive, assuring your gift will always be relevant.

What is Planned Giving?

As the name implies, Planned Giving is part of an overall financial or estate plan. Donors have the flexibility to place guidelines on the use of the gift or leave it unrestricted, which is the most common type of gift we receive.

Examples of Planned Gifts

A Bequest is the easiest way to make a planned gift. You can leave a gift to charity by including a bequest in your will or trust.

Charitable Gift Annuities or Charitable Remainder Trusts allow the donor to increase annual income for a specified period or for life and receive favorable tax treatment.

Charitable Lead Trusts make small payments to United Way. After a specified period, the principal revers to the donor or other beneficiary. These trusts can offer estate and gift tax advantages.

Gifts of new or existing life insurance policies can offer immediate and estate tax deductions.

Gifts of cash or appreciated securities can offer immediate tax deductions, in addition to estate tax benefits.

Please be sure to consult with financial or legal advisors before making a planned gift.

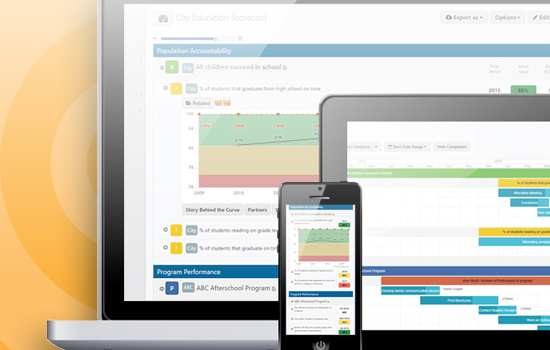

Past Planned Giving Webinars

View our collection of planned giving seminars from United Way partners covering a wide array of financial planning and charitable giving strategies.

United Way Legacy Society

Your planned gift to United Way qualifies you for membership in United Way’s Legacy Society, an exclusive group of donors with an expressed interest in the future well-being of our community. As a member, you will receive recognition in UWGT’s online Donor Recognition Book, as well as invitations to UWGT and Legacy Society events. Fill out the inquiry form below to receive more information about Planned Giving.